Indicators on Mortgage broker St. Louis You Should Know

Navigating the home getting method may be a frightening job, significantly In regards to securing a mortgage loan. This is when mortgage brokers Engage in an important role. Acting as intermediaries amongst borrowers and lenders, property finance loan brokers aid possible homeowners locate the most effective home loan merchandise to go well with their economical circumstances. In this post, We'll check out what home finance loan brokers do, their benefits, how they vary from loan officers, and tips on choosing the right broker for your needs.

What's a Home loan Broker?

A mortgage loan broker is actually a licensed and controlled economical Experienced who functions being a liaison amongst borrowers and house loan lenders. As opposed to mortgage officers who work for unique banking companies or fiscal institutions, mortgage brokers work independently and also have access to a variety of house loan goods from various lenders. Their Key aim is to locate the very best mortgage phrases and rates for his or her clients.

The Purpose of a Home finance loan Broker

Assessment of economic Situation: House loan brokers begin by evaluating a borrower’s economical circumstance. This will involve knowing the shopper’s credit rating record, earnings, debts, together with other monetary commitments.

House loan Products Comparison: They then Evaluate a variety of property finance loan goods offered on the market. Because of their extensive network, they can provide clientele with various solutions which they may well not find on their own.

Software Assistance: Brokers assist in completing the home loan application procedure. They help gather essential documentation and make sure that programs are accurately filled out and submitted instantly.

Negotiation: Brokers negotiate with lenders on behalf of your borrower to protected the absolute best home finance loan phrases. This may contain reduced interest rates, improved repayment phrases, and lowered charges.

Guidance and Information: All over the approach, mortgage loan brokers provide important assistance and assistance, aiding clients have an understanding of their house loan choices and make educated choices.

Great things about Using a Property finance loan Broker

Entry to More Possibilities: Because brokers have associations with numerous lenders, they can offer usage of a wider choice of home loan solutions.

Experience and Practical experience: Brokers possess in depth expertise in the home loan sector and present-day marketplace tendencies, that may be incredibly helpful for borrowers that are unfamiliar with the procedure.

Time Price savings: Brokers deal with Considerably with the legwork linked to securing a mortgage, saving customers time and lowering pressure.

Probable Price tag Savings: By negotiating on behalf of the borrower, brokers can frequently secure much better prices and terms, potentially preserving shoppers thousands of pounds about the lifetime of the house loan.

House loan Broker vs. Bank loan Officer

Although each home loan brokers and loan officers guide in securing household loans, you will find crucial variations between The 2:

Mortgage loan Broker: Functions independently or which has a brokerage agency, supplying usage of a number of lenders and goods.

Personal loan Officer: Utilized by a single lender, presenting mortgage loan products and solutions only from that institution.

The first advantage of dealing with a broker is the ability to store around for the ideal deal, While a personal loan officer can provide additional direct entry to a selected bank’s merchandise and can have a lot more in-depth familiarity with that establishment’s offerings.

Guidelines for selecting a Home loan Broker

Investigation and Referrals: Get started by asking buddies, household, or your housing agent for recommendations. Analysis likely brokers on the web and browse critiques from past clientele.

Credentials and Licensing: Be certain that the broker is accredited As well as in fantastic standing with regulatory bodies. During the U.S., you can verify a broker’s license through the Nationwide Multistate Licensing Method (NMLS).

Encounter and Knowledge: Try to find a broker using a verified background and substantial expertise inside the mortgage loan business. They should be professional about the precise form of bank loan you will need.

Transparency and Communication: Decide on a broker that is transparent with regards to their costs And the way they are compensated. Fantastic Mortgage loans conversation can also be very important; the broker need to be responsive and ready to explain all areas of the mortgage loan process.

Compatibility: Eventually, pick a broker you really feel cozy with and who understands your financial ambitions and needs.

Conclusion

Property finance loan brokers Engage in A necessary part in the house buying approach, offering skills, a variety of home loan selections, and personalized help. By serving to borrowers navigate the complexities of securing a mortgage, brokers might make the aspiration of homeownership extra accessible and cost-effective. Whether you are a primary-time homebuyer or wanting to refinance, a qualified mortgage loan broker can be quite a precious partner in your home financing journey.

Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Brandy Then & Now!

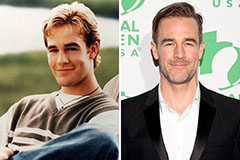

Brandy Then & Now! James Van Der Beek Then & Now!

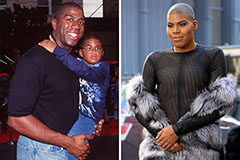

James Van Der Beek Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now!